August 11, 2025 – Bankruptcy Judgeship Vacancy – [Extension of application period until September 5, 2025] -The United States Court of Appeals for the Second Circuit invites applications from qualified candidates for a 14-year appointment as United States Bankruptcy Judge in the Western District of New York (Rochester). The extension deadline to submit an application is September 5, 2025. If you applied earlier, there is no need to re-submit your application. For announcement, please click here. For application, please click here.

Bankruptcy Judgeship Opportunity, Western District of New York – United States Court Of Appeals For The Second Circuit

Bankruptcy Judgeship Vacancy – The United States Court of Appeals for the Second Circuit invites applications from qualified candidates for a 14-year appointment as United States Bankruptcy Judge for the Western District of New York. The duty station for this opportunity is in Rochester New York. For announcement click here, for application click here. The deadline to submit an application is August 7, 2025.

Bankruptcy Judgeship Opportunity, Eastern District of New York – United States Court Of Appeals For The Second Circuit

Bankruptcy Judgeship Vacancy – The United States Court of Appeals for the Second Circuit invites applications from qualified candidates for a 14-year appointment as United States Bankruptcy Judge for the Eastern District of New York. There are two vacancies in the Eastern District of New York, one in Brooklyn and one in Central Islip. For announcement click here, for application click here. The deadline to submit an application is August 7, 2025.

AABANY’s Commercial Bankruptcy and Restructuring Committee and Young Lawyers Committee Host Ice-Skating Social at Bryant Park

On January 16, 2025, AABANY’s Commercial Bankruptcy and Restructuring Committee (CBRC) and Young Lawyers Committee (YLC) hosted an ice-skating social at Bryant Park to start off the New Year. The Committees welcomed members of all skating abilities, from first timers to experienced skaters who helped the first timers hone their skating skills as they circled the ice. The event featured some light snow, which enhanced the experience for our attendees.

After skating, attendees networked over après-skating drinks and food at the Vanderbilt Bar & Grill and discussed different areas of law, including bankruptcy and restructuring, intellectual property, commercial real estate and the judiciary.

A big thank you to everyone who attended! The Commercial Bankruptcy and Restructuring Committee as well as the Young Lawyers Committee always welcome new members to join our growing and dynamic community.

To learn more about the Commercial Bankruptcy and Restructuring Committee and the Young Lawyers Committee as well as how you can get involved, visit the Commercial Bankruptcy and Restructuring Committee and Young Lawyers Committee Committee pages on the AABANY website.

AABANY Committees Host a Panel on Pursuing a Specialization in Bankruptcy

What is bankruptcy law? How does it differ from general litigation and transactional practices? Why do people call it “restructuring?” And how do I get a job in this amazing field?

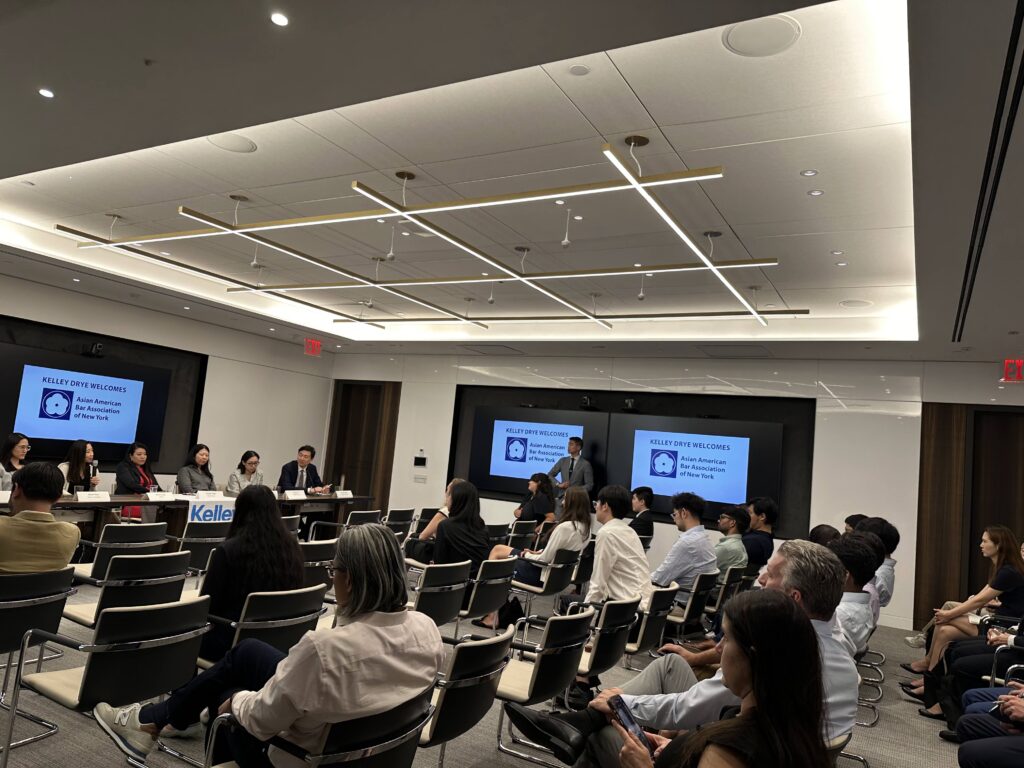

On July 11, 2024, AABANY’s Commercial Bankruptcy and Restructuring, Student Outreach, and Young Lawyers Committees held a panel at the offices of Kelley Drye & Warren LLP to answer these questions—hopefully enticing students and junior attorneys to join the next generation of corporate bankruptcy lawyers and providing added perspectives for the benefit of current legal and non-legal practitioners in the audience.

Our all-female, all-AAPI panel of attorneys from leading law firms—Cleary Gottlieb, Kelley Drye, Mayer Brown, Sidley, and Skadden Arps—went deep. They talked about the nuances of the corporate bankruptcy and restructuring practice and why it is such an appealing field. It’s a great mix of litigation and transactional work, the panelists emphasized, the work is dynamic and varies based on the nature of one’s representation, and bankruptcy’s faster pace makes it rather exciting and provides hands-on experience earlier on in an attorney’s career. The panel also fielded various questions from the strongly turned-out audience such as what qualities make for an effective bankruptcy lawyer and why the practice tends to concentrate in New York.

What further came out of the panel and the rest of the evening was just how closely knit the bankruptcy world is. During the reception, attendees caught up with old colleagues at other firms, and new and old friends stayed long after they finished their last glasses of wine.

Thank you to our panelists Connie Choe, Dabin Chung, Weiru Fang, Hoori Kim, and Shan Lu for their insights, to Patrick Chen and Justin Lee for moderating, and especially to Kelley Drye for hosting our event.

To find out more about the Commercial Bankruptcy and Restructuring Committee, please click here.

To find out more about the Student Outreach Committee, please click here.

To find out more about the Young Lawyers Committee, please click here.

AABANY Restaurant Series Dines at Cafe China

On May 12, 2022 the Membership and Bankruptcy Committees hosted a dinner at Cafe China. The acclaimed restaurant is known for its classic Sichuan favorites such as cumin lamb and tea-smoked duck. Membership Vice Chair Ashley Shan planned the family style menu, and the group had a great time discussing food, tv and career goals.

We thank Will Hao, Bankruptcy Chair, for co-hosting!

AABANY is trying to support small Asian owned businesses and restaurants through our Restaurant Series, which will be held twice a month. Our next event is at Louie’s Pizza, whose owner and his father stood up for the victim of an anti-AAPI attack. Louie and Cazim courageously came to the help of an elderly Korean woman who was being robbed and attacked in front of their store and were themselves stabbed in the process. We hope you will join us in supporting the restaurant on May 28, 1pm at Louie’s Pizza (8134 Baxter Ave, Queens). For more information and to register, please visit https://www.aabany.org/events/event_details.asp?legacy=1&id=1638502. For more information, please email Membership Director Christopher Bae at [email protected].

AABANY Student Outreach Committee and Bankruptcy Committee Present: What Do Bankruptcy Lawyers Do?

On February 9, AABANY’s Student Outreach & Bankruptcy Committees hosted a virtual panel discussion on legal careers in bankruptcy and restructuring. The event, part of the Student Outreach Committee’s Students Meet Mentors Series, ran from 6:00 pm to 7:15 pm on Zoom. The panel was moderated by Student Outreach Committee Co-Chair Long Dang (Columbia Law School ‘22) and AABANY Student Leader Sharon Yang (Fordham Law School ‘23) and featured the following distinguished bankruptcy attorneys:

- William Hao (Counsel, Alston & Bird),

- Hoori Kim (Associate, Cleary Gottlieb),

- Mike Paek (Chief Deputy Clerk, Southern District of New York Bankruptcy Court) and

- Courina Yulisa (Associate, Dorsey & Whitney).

Panelists discussed their day-to-day lives as bankruptcy attorneys, recommended classes for interested law students (e.g., Secured Transactions, Basics of Bankruptcy), and shared their perspective on the bamboo ceiling in the industry. The discussion was followed by a participant Q&A, where audience members asked questions about the use of technology in bankruptcy law. The evening ended with a gift card raffle for attendees. Congratulations to Maggie Fang of the University of Pennsylvania Law School for winning the raffle!

AABANY thanks the Student Outreach & Bankruptcy Committees for organizing the event and all panelists, moderators, and students who attended. To learn more about the Student Outreach Committee, please visit https://www.aabany.org/page/121. To learn more about the Commercial Bankruptcy and Restructuring Committee, please visit https://www.aabany.org/page/353.

Pro Bono and Community Service Committee’s Pro Bono Clinics Serve Numerous Community Members in September and October

AABANY’s Pro Bono & Community Service (PBCS) Committee would like to thank everyone who attended the second and third hybrid Manhattan pro bono clinics in September and October, as well as the soft opening of the Queens pro bono clinic this past Saturday, Oct. 30. The three clinics assisted a total of fifty-five (55) clients, who sought advice on a range of topics, including housing law, immigration, elder law, loans and contracts, marriage and divorce, estates law and drafting of wills and powers of attorney, discrimination, 9/11 compensation, and fraud. PBCS and AABANY are grateful to the Chinese Consolidated Benevolent Association (CCBA) and Asian Americans for Equality (AAFE) for co-sponsoring and hosting these clinics.

The clinics for the past two months could not have happened without the gracious help of many AABANY members and committees. During the September pro bono clinic, in collaboration with AABANY’s Bankruptcy Committee, PBCS provided a “Know Your Rights” presentation on the topic of bankruptcy and consumer debt. During the October clinics, Rina Gurung and Kevin Hsi, two of the three co-chairs of AABANY’s Government Service and Public Interest Committee, and Zhixian (Jessie) Liu, a co-chair of AABANY’s Immigration Committee, helped PBCS out by volunteering to see clients for one-on-one informational consultations. Thanks to AABANY’s Committees for their camaraderie!

At the pro bono clinics, PBCS volunteers use quick issue-spotting skills to help members of the AAPI community and those with limited English proficiency know what their rights are. For instance, while answering housing questions, a volunteer discovered that a 70-year-old couple living at a rent-stabilized apartment was eligible for the Senior Citizen Rent Increase Exception (SCRIE). SCRIE is a program that allows qualified tenants to have their rent frozen at their current level and be exempt from future rent increases. This is crucial since most seniors depend on their fixed income. If their rent goes up, qualified SCRIE tenants do not have to pay the higher rent, as the City will pay the landlord the difference between the current rent and the future rent. The 70-year-old couple who came into the PBCS clinic will receive assistance from AAFE to apply for SCRIE.

In order to be eligible for SCRIE, an applicant must be 62 years or older, have less than $50,000 in household income, spend more than 1/3 of monthly income on rent, and reside in a NYC rent-stabilized apartment, rent-controlled apartment, rent-regulated hotel or single room occupancy unit, Mitchell-Lama development, Limited Dividend Housing Company development, Redevelopment Company development, or Housing Development Fund Company development. Senior citizens who own homes, condominiums or private non-government supervised co-ops may also be eligible for SCRIE. To learn more about SCRIE, see https://access.nyc.gov/programs/senior-citizens-rent-increase-exemption-%E2%80%8Bscrie/.

To learn more about the PBCS Committee and its work, click here and here. The next hybrid legal clinics will take place on Saturday, November 6, 2021 from 11:00 a.m. to 3:30 p.m. at AAFE, 2 Allen Street (2nd Floor), New York, NY 10002; and Saturday, November 13, 2021, from 12:30 to 3:30 p.m. at CCBA, 62 Mott Street (2nd Floor), New York, NY 10013. For up-to-date details about the clinic and other events, please check PBCS’s event calendar.

And as always, we are always looking for volunteers to help us out!

To volunteer at CCBA’s Clinics – https://airtable.com/shrQFecVpU1u5ltAy

To volunteer at AAFE’s Clinics – https://airtable.com/shrtPeVTibQA9qNgD

AABANY thanks the following September 18, 2021 Manhattan CCBA Clinic Volunteers:

| AABANY | AAFE |

| Asako Aiba* | |

| Chao Yung (Kloe) Chiu | |

| Megan Gao | |

| Chenxin (Sarah) Li | |

| Eugene Kim | |

| Jason Kuo | |

| Judy (Ming Chu) Lee | |

| Karen Lin | |

| Erxian (Estelle) Lu* | |

| Jayashree Mitra | |

| Kensing Ng* | |

| Kwok Ng | |

| Grace Pan | |

| Anthony Park* | |

| S. Yan Sin | |

| Tina Song | |

| May Wong | |

| Courina Youlisa* | |

| Serena Zou^ |

AABANY thanks the following October 16, 2021 Manhattan CCBA Clinic Volunteers:

| AABANY | AAFE |

| Xuanyou (Alicia) Chen | Luna Fu^ |

| Francis Chin | |

| Yoonhee Kim* | |

| Judy (Ming Chu) Lee* | |

| Karen Lin | |

| Zhixian Liu | |

| Erxian (Estelle) Lu^* | |

| Megan Gao | |

| Kwok Ng | |

| Kendall Park^* | |

| S. Yan Sin | |

| Johnny Thach | |

| Annie Tsao | |

| Bill Yang^* | |

| Teresa Wai Yee Yeung^ | |

| May Wong | |

| Meng Zhang* |

AABANY thanks the following October 30, 2021 Queens Clinic Volunteers:

| AABANY | AAFE |

| Esther Choi^ | Lilian Cheung |

| Megan Gao | Luna Fu |

| Rina Gurung | Gabriel Hisugan |

| Kevin Hsi | |

| Eugene Kim | |

| Kendall Park^* | |

| Rachel Ji-Young Yoo* | |

| May Wong |

^Non-attorney volunteers

*Remote volunteers

AABANY Student Outreach and Bankruptcy Committees Co-Hosted Successful “What Do Bankruptcy Lawyers Do?” Panel on February 11

The Student Outreach and Bankruptcy Committees co-hosted a panel titled “What Do Bankruptcy Lawyers Do?” on February 11, 2021 as part of the SOC’s Students Meet Mentors series. William Lee, Associate at Alston & Bird, moderated the panel and speakers included William Hao, Counsel at Alston & Bird; Jessica Liou, Partner at Weil; Charlie Liu, Associate at Morgan Lewis; and Geoffrey Williams, Associate at Alston & Bird. The panel provided law student attendees an opportunity to learn about the bankruptcy and restructuring practice area and what being a bankruptcy attorney entails.

William Lee began the event by asking panelists to give an introduction of what bankruptcy and restructuring is. Panelists described bankruptcy as a tool companies are given to reorganize themselves and remove liability pre-bankruptcy. Restructuring encompasses a wide spectrum of processes available to companies, such as filing for court protection, financial restructuring, and operational restructuring. William Hao summarized chapters 7, 11, and 13, the three most common processes used by bankruptcy lawyers.

Next, panelists were asked to describe their experiences working as a bankruptcy and/or restructuring lawyer. Jessica Liou stated that bankruptcy and restructuring is flexible and described it as a hybrid between litigation and transactional work. Some lawyers work in the bankruptcy-litigation niche, while others take the transactional route. When asked what type of student would fit the mold of a bankruptcy lawyer, panelists answered that it would be someone who is interested in a variety of things. Not only can a bankruptcy case be quick-paced, but a bankruptcy lawyer also gets to work with different groups in the firm, such as the tax group, executive compensation group, or litigation group. No two bankruptcy cases are the same, so a bankruptcy lawyer must be willing to do and understand many different things. Jessica Liou also shared how it is extremely rewarding to be a restructuring lawyer as she helps save jobs and helps companies get a second chance.

The panel concluded with tips and recommendations to students who may be interested in getting involved in the bankruptcy and restructuring practice area. Panelists suggested that students should look for opportunities to get exposure to bankruptcy. These include trying an internship or bankruptcy judicial clerkship, taking a bankruptcy course, talking to bankruptcy lawyers, or participating in the Duberstein Moot Court competition.

Thank you to the Student Outreach Committee and the Commercial Bankruptcy and Restructuring Committee for organizing this informative panel. And thank you to William Lee for moderating and to William Hao, Jessica Liou, Charlie Liu, and Geoffrey Williams for volunteering their time and sharing their experiences. To learn more about the Commercial Bankruptcy and Restructuring Committee, go to https://www.aabany.org/page/353. To learn more about the Student Outreach Committee, go to https://www.aabany.org/page/121.

AABANY Co-Sponsors Panel on Small Business Navigation of COVID-19

On June 23, the Asian American Bar Association of New York (“AABANY”) presented its Small Business Navigation of COVID-19: A Briefing on Relief and Remedies panel as a part of AABANY’s wider initiative to provide support for those adversely affected by COVID-19. The event highlighted professionals working in a variety of fields and addressed concerns regarding how to safely open up and potential next steps for small businesses. The panel was moderated by Margaret Ling, Senior Counsel at Big Apple Abstract Corp. and Co-Chair of the AABANY Real Estate Committee, and featured Amol Pachnanda, Partner at Ingram Yuzek LLP and Co-Chair of the AABANY Real Estate Committee; William Ng, Shareholder at Littler Mendelson P.C.; Anthony Kammas, Partner at Skyline Risk Management, Inc.; William Hao, Counsel at Alston & Bird LLP and AABANY Treasurer; and Anthony M. Bracco, Partner at Anchin Accountants and Advisors.

Amol Pachnanda began by discussing COVID-19’s effect on the tenant-landlord relationship and best practices for tenants to avoid eviction. Tenants should be familiar with the lease agreement and seek legal counsel in any disputes with the landlord. Communication between tenants and landlords is critical as both parties possess significant incentives to avoid eviction. Tenants should be aware that the Moratorium on Evictions has been extended for an additional 60 days and any rent demands must be nullified if the tenant states that they have been impacted by COVID-19. Additionally, New York State real estate personal guarantees and “Good Guy Guarantees” have been made non-enforceable as tenants are no longer legally bound to vacate within a set timeframe if they are unable to pay their rent.

William Ng addressed how small businesses should reopen and some of the potential legal issues with phase 2 and phase 3 reopening. Business owners must go online and complete the New York Forward safety plan template and keep the plan on the premises at all times. Each business must affirm whether they have submitted a plan or have a plan in place during inspections. Small businesses are also encouraged to maintain a cleaning plan and document daily hygiene and sanitation activities to limit employer liability in the event that an employee does contract COVID-19. If an employee does contract COVID-19, small business owners are responsible for reporting the case to the relevant authorities and putting together a plan that ensures the safety of the other employees. The plan should include contact tracing measures and other appropriate protocols to limit contact and exposure.

Anthony Kammas discussed how small businesses can maintain their insurance coverage while reopening and other ways to mitigate liability. Employers should review their business policies and keep detailed records of their sanitation efforts to make sure they can retain their coverage in the event that individuals claim they contracted COVID-19 on the premises. Moreover, it is critical that employee handbooks are updated to address the challenges currently posed by COVID-19. Employers should also be mindful of the HIPAA liabilities associated with additional employee screenings. If employers contact trace, any information regarding the infected individual must remain confidential. As many policies do not cover the cost of sanitation and cleaning, Anthony Kammas recommends seeking third-party cleaning services to shift liability down away from the business owner and to the cleaning service if an incident were to occur. Small business owners should be more careful when buying new policies as carriers are becoming increasingly narrow in their wording to avoid excessive coverage.

William Hao then explained how Chapter 11 bankruptcy may be a viable option for struggling small businesses. Chapter 11 bankruptcy focuses on restructuring and reorganizing as the business undergoes a court-supervised process by which creditors and debtors come together to discharge bad debts and re-negotiate contracts and formulate a plan moving forward. Filing for Chapter 11 bankruptcy provides a business a set of tools and leverages to incentivize creditors to come to the table and establish an agreeable plan for all parties. Businesses are entitled to an automatic stay, which stops any litigation and collection efforts that are burdening them. Businesses can also reject bad contracts during this process. Creditors are incentivized to negotiate with debtors as creditors are aware that any contracts paid out during this time would amount to a smaller fraction of the original debt. In addition, the absolute priority rule is voided, and other regulations and costs that had previously barred small businesses from filing for Chapter 11 bankruptcy have been waived.

Lastly, Anthony Bracco discussed how small businesses can still apply for benefits under the Payment Protection Program (“PPP”) and the Economic Injury Disaster Loan (“EIDL”). Under the PPP, small businesses can apply for up to two and a half months’ worth of employee payroll costs with any new loans having a five-year repayment period. These loans qualify for 100% loan forgiveness if they are spent within 24 weeks and at least 60% is spent on payroll costs. The percentage of loan forgiveness is reduced if employers reduce the compensation of anyone earning $100,000 by 25% or more or reduce full-time equivalents. However, employers are not accountable for restoring full-time equivalent employment if employees are not willing to return to work or due to government shutdown. Small business owners can apply for loan forgiveness any time within the 24 week window if all of the PPP loan is spent. As for the EIDL, small business owners can obtain a loan up to $150,000 with an advance loan of $10,000. Even if the full EIDL loan is not granted, small business owners are entitled up to the $10,000 advance loan. Small business owners can apply for both the PPP and the EIDL but must deduct the $10,000 EIDL advance loan from the PPP loan. Anthony Bracco also described different options available for small business owners to cover employee costs in addition to applying for the PPP. Instead of cutting headcount by a certain percentage, small business owners can reduce employee salaries by the percentage of those that were to be terminated and the Department of Labor will cover a portion of the pay lost.

We would like to thank Margaret Ling for moderating and organizing this informative event and the panelists for their time and dedication to help those adversely affected by COVID-19. To learn more about the Real Estate Committee, click here. To view the recording from the webinar click on the image above.