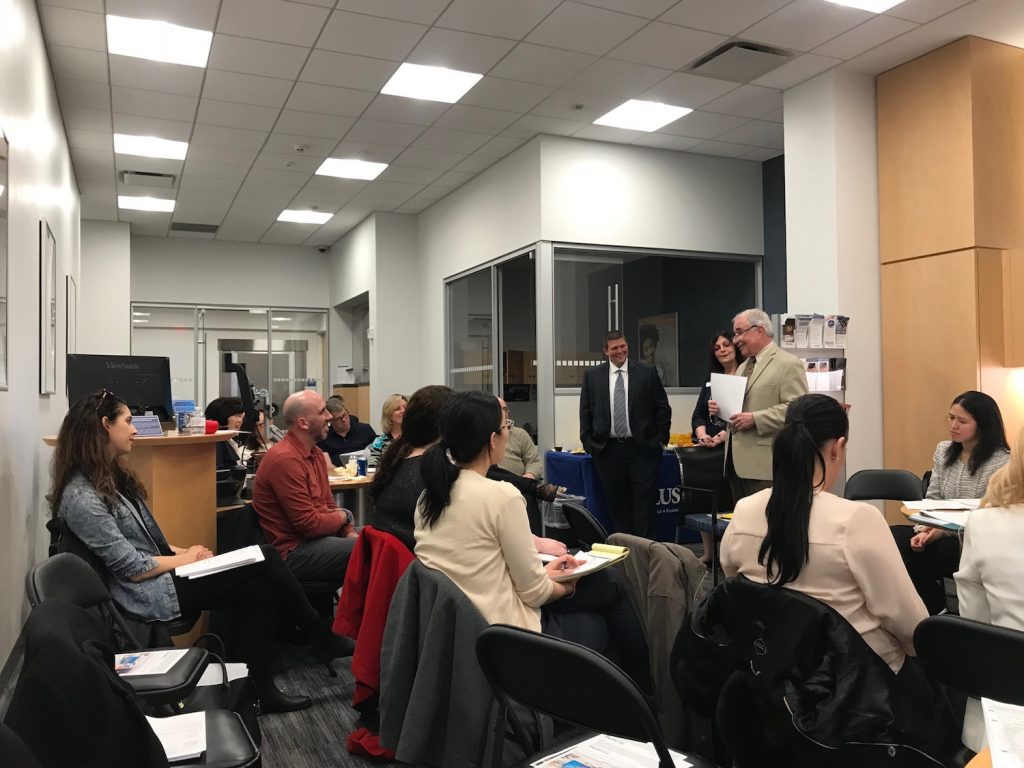

AABANY extends our sincerest gratitude to the Asian American Law Fund of New York (AALFNY), AABANY’s Pro Bono and Community Service (PBCS) Committee, Asian Americans for Equality (AAFE), and all of our dedicated volunteers for contributing to the success of our Pro Bono Legal Clinic on June 18th, 2025.

During the clinic, our volunteers met with clients addressing issues ranging from housing, real property, financial, family and matrimonial matters. Our volunteer attorneys and interpreters demonstrated exceptional expertise in addressing client concerns, answering legal questions, and connecting them with legal resources through AABANY’s Legal Referral and Information Service (LRIS).

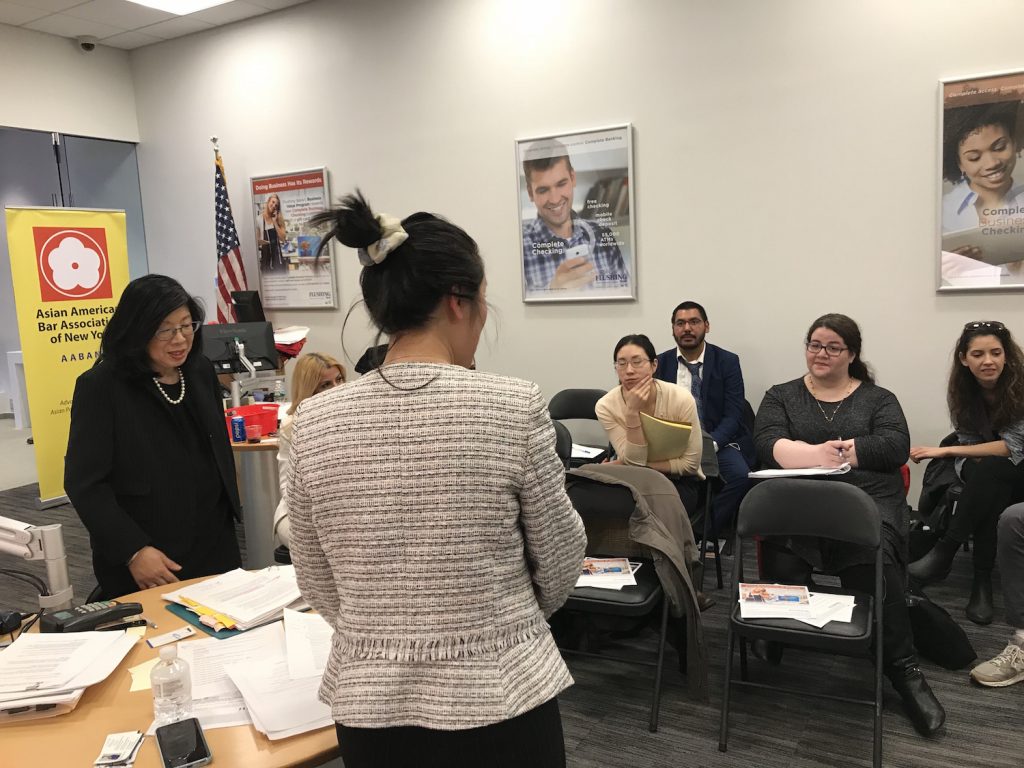

College and law student volunteers gained valuable hands-on experience that deepened their understanding of the unique legal challenges faced by underserved individuals in the Asian American and Pacific Islander community. By shadowing the volunteer attorneys, the student volunteers assisted with client intake and helped translate the consultations. A frequent issue clients faced at this clinic were overdue rent and unexpected payment notices. Due to the linguistic barriers that many clients faced, they often struggled to understand their rights, which led to ineffective communication with landlords and housing authorities. This confusion contributed to heightened stress about their circumstances. Our volunteer attorneys and interpreters played a crucial role in clarifying legal obligations and guiding clients through potential future steps.

We are dedicated to providing services in both Mandarin and Cantonese to ensure support for individuals who may struggle to obtain quality legal services due to linguistic or cultural barriers when seeking guidance concerning substantive laws and procedural issues.

Thank you again to all of our volunteers at the June 18 Manhattan Pro Bono Clinic:

Volunteer Attorneys

| Justin Lee |

| Beatrice Leong |

| Lily Li |

| Bich-Nga Nguyen |

| Cynthia Park |

| Tammy Tran |

| Mike Tse |

| Chenyi Wang |

| May Wong |

| Gary Yeung |

| Jungeun “Evelyn” Yu |

| Francis Chin |

Interpreters/Shadowers

| Sisu Chou |

| Katelyn Hai |

| Emily Kam |

| Nandar Win Kerr |

| Nikita Kohli |

| Emily Lai |

| Nasirn (Nienyin) Lin |

| Carrie Nie |

| Christine Shea |

| Tianyuan Shu |

| Tammy Tam |

| Albert Tong |

| Shang Zhai |

| Kenny Ip |

We invite you to continue supporting our community by joining us at our upcoming pro bono clinics:

July 12 [Brooklyn link here], from 12:30-2:30 pm, CPC Brooklyn Community Services, 4101 8th Avenue, Brooklyn, NY 11232

July 16 [Manhattan link here], from 6:30-8:30 pm, AAFE Community Center, 111 Norfolk Street, NY, NY 10002

August 6th [Queens link here] from 6:30-8:30 pm, One Flushing Community Center, 133-29 41st Ave, 2nd Floor, Flushing, NY 11355

Thank you once again to all our volunteers for their commitment to pro bono service and for making a meaningful difference in our community.

We look forward to your participation in our future clinics!

To learn more about the Pro Bono & Community Service Committee, visit probono.aabany.org.